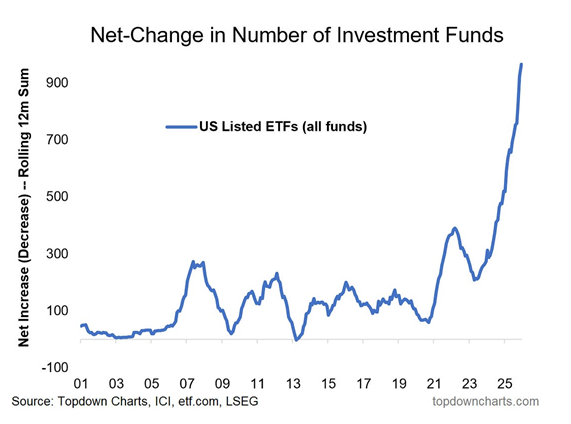

1. Game On…Bet on Anything

Callum Thomas

2. U.S. Dollar Worst Year Since 2003

Hedgeye

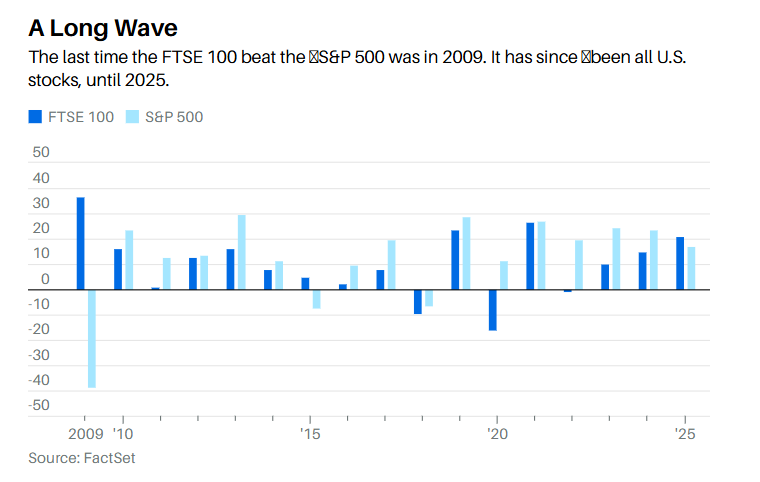

2. FTSE 100 UK Market Outperformed S&P for First Time Since 2009

Barron’s

3. Copper Miner FCX Making Run at 20-Year Breakout

Google Finance

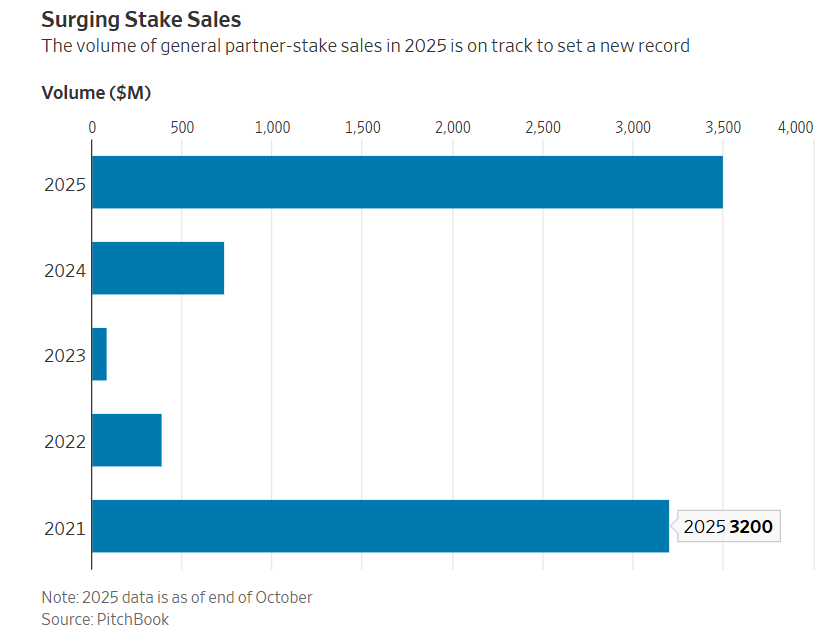

4. Private Equity Selling a Record Amount of General Partner Stakes

WSJ The market for general-partner stakes—investments in a private asset manager that typically let the buyer share in management fees and deal profits—rebounded in 2025 after three lean years. GP-stake deal volume totaled $3.5 billion through the end of October, on pace to easily exceed the record of $3.6 billion set in 2015, according to PitchBook data. And the market could expand dramatically over the next two years. A survey of fund managers by law firm Dechert showed that 77% plan a stake sale in the next 24 months, up from 34% in last year’s survey.

WSJ

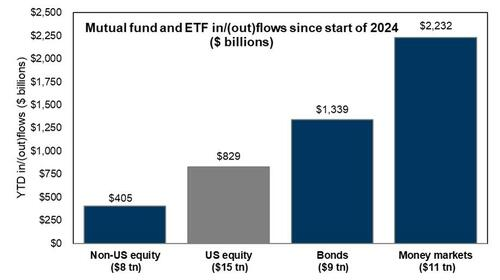

5. Post Tariffs—Still Large Increase in Foreign Demand for U.S. Assets

Continued Strong Foreign Demand for US Assets

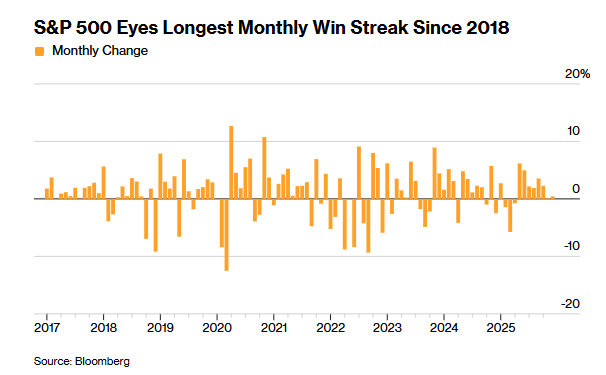

Despite the turbulence surrounding Liberation Day in April, foreign investors ended up buying more US assets in 2025 than in 2024, see chart below.

Note: 2025 data is annualized. Sources: US Department of Treasury, Macrobond, Apollo Chief Economist

6. CPA Exam Goes Back to In-Person

Semafor

7. Google Now Keeps Line Item for “Euro Fines”

The Kobeissi Letter

8. U.S. Religion Per 100 People

Visual Capitalist

9. USA’s safest and most dangerous cities ranked

Crime rates are often viewed as the best way to determine if a city is safe, but a recent push seeks to expand the definition of safety.

USA TODAY

What are the top 10 safest cities?

The top 10 safest cities in the United States, according to WalletHub, are:

- Warwick, Rhode Island

- Overland Park, Kansas

- Burlington, Vermont

- Juneau, Alaska

- Yonkers, New York

- Casper, Wyoming

- South Burlington, Vermont

- Columbia, Maryland

- Lewiston, Maine

- Salem, Oregon

What are the top 10 most dangerous cities?

The nation’s top 10 most dangerous cities (or the least safe of the 182 ranked), according to WalletHub, are:

- New Orleans

- Memphis, Tennessee

- Baton Rouge, Louisiana

- Detroit

- Baltimore

- Fort Lauderdale, Florida

- Houston

- San Bernardino, California

- Philadelphia

- Cleveland

https://www.usatoday.com/story/news/nation/2025/12/29/safest-most-dangerous-cities-2025/87568616007

10. Michael Jordan Says His Bulls Contract Had a Clause He’s Positive No Players Today Have. It’s the Secret to Becoming the Best

In a recent interview, Michael Jordan speaks about the “love of the game” clause from his playing days, and how that helped shape the player he became.

EXPERT OPINION BY JUSTIN BARISO, AUTHOR, EQ APPLIED @JUSTINJBARISO

is widely recognized as one of the best basketball players to ever live. In a recent interview, Jordan revealed one of the secrets to his success:

His love of the game.

Jordan says he loved the game so much he made sure to have a special clause included in his contract when playing with the Chicago Bulls, one which he’s “positive” players today don’t have: the “love of the game” clause.

“If I was driving with you down the street, and I see a basketball game on the side of the road, I can go play in that basketball game,” Jordan told NBC’s Mike Tirico. “And if I get hurt, my contract is still guaranteed.”

Jordan went on to explain that constant practice, not just doing drills but playing real games, helped him and other NBA players like Larry Bird master their craft. It was playing in games that helped players develop their love of basketball, and helped them remain passionate about the game, rather than just viewing it as a job.

“I love the game so much, I would never let someone take the opportunity for me to play the game away from me,” Jordan said.

Jordan’s “love of the game” clause teaches us an important secret to finding career success, namely: To truly become the best at what you do, you have to love it.

This secret is related to emotional intelligence, the ability to understand and manage emotions to reach a goal. How can you leverage emotional intelligence to master what you do? Let’s explore. (If you enjoy this article, consider signing up for my free emotional intelligence course.)

Leveraging your ‘love of the game’

To clarify, Jordan wasn’t speaking about becoming the best basketball player ever.

Although countless fans and analysts alike have pegged Jordan as the GOAT (greatest of all time), Jordan typically steers away from that conversation, saying that title disrespects the basketball legends who’ve come before him, and the players who play today.

Rather, Jordan was primarily interested in reaching his full potential—and his love of the game fueled that drive. “Basketball was that type of love for me,” Jordan said. “I had to find a way to make sure I was the best basketball player I could be.”

Jordan’s success led to his becoming the wealthiest professional athlete in history. Most of his earnings didn’t come from his playing contracts, though. Rather, they resulted in multiple business ventures and branding deals, most notably the Jordan brand with Nike.

But Jordan says for him, the brand never affected what he was going to do on the basketball court.

Maximizing Productivity: How a Busy Event Design and Production Firm Saves Time, Money, and Hustle

“I put the work first, and then the brand evolved based on the work,” Jordan said. “We would play this game for free. We did. And now we just happen to get paid for it.”

So, how can you apply this to your own work?

There are several reasons business owners run the businesses they do. You may have taken over a family business. Maybe you dabbled in the world of self-employment and discovered you enjoyed the freedom it offered. Other entrepreneurs become so out of necessity: Mark Cuban started his first business after getting fired.

But regardless of how you got into the business you now run, the secret to mastering your craft is to develop a love for what you do.

Ask yourself:

- What aspects of my work do I really love? The things I’d do for free?

- How can I practice those things as much as possible?

- How can I further leverage that love to master my craft?

As you answer those questions, and as you put in the work, you’ll find yourself constantly improving, continually growing, and consistently becoming a better (work) version of yourself. Because if there’s one thing that Michael Jordan taught us, it’s that natural ability, talent, and skill will get you far, but love is what makes you the best.